33+ First time homebuyer down payment

Part of the home buying process should include how much home can you afford and not what you qualify for. This program is for applicants with a maximum household income below the.

3843 New Kings Bridge Rd Nicholson Ga 30565 Realtor Com

Short to long-term budgeting.

. CLTV 95 requires secondary financing to be an affordable down payment assistance program layer. This money could go toward various home-buying expenses that would otherwise prohibit a person from buying a property. Additional restrictions apply for 2-unit properties.

In addition to loan programs that have a low down payment requirement there are first-time homebuyer down payment assistance programs. Programs and grants are available to help you with your down. The 25000 Downpayment Toward Equity Program Expected in 2022.

If you qualify for a VA loan you wont need a down payment. Increasing income through additional. Some of the items the money could be used for include.

Up to 97 loan-to-value105 combined loan-to-value. But its more common to find down payment requirements of 10 or more. The homebuyer must occupy the property as a primary residence.

There are many first time home buyer programs and grants available to you to help you make your first real estate purchase. If bad credit inhibits you from buying your first house consider a loan through the Federal Housing Administration which can aid low-income buyers assist with a first time home buyer down payment and buyers with poor credit. Fortunately there are first-time homebuyer.

A loan officer may qualify a home buyer for a 350000 home loan. The average first-time homebuyer down payment 6 across all states is 12274. The average down payment on a house for a first-time homebuyer was 7 percent in 2021 according to the National Association of Realtors.

First Time Home Buyer Down Payment Credit Assistance Based Programs. In 2021 Congress introduced a bill titled The Downpayment Toward Equity Act a home buyer grant for. One of the most popular financing options for first-time buyers is an FHA loan which is offered by a traditional mortgage lender but backed by the government.

Some first-time buyers may qualify for down payments as low as 3. If you have a. Loan amounts up to 647200 with 3 down payment and up to 970800 with 5 down payment in high-cost areas.

A down payment of 20 on a 400000 home would be. For example the Chenoa. Got the Down Payment Blues - Got the Down Payment Blues The Alt 97 Flex 97 and Flex 100 programs backed by Fannie Mae and Freddie Mac are becoming increasingly popular.

First-time homebuyers are expected to pay an average of 1983 in closing costs on top of a down. The Down Payment Toward Equity Act is a bill promoted by president Biden that will give up to 25000 to those purchasing a home for the first time. There are many ways to save for a first time homebuyer down payment.

The step by step method we used to receive 33 downpayment assistance from the city of San Diego. With this program the Housing Authority will match dollar for dollar a First Time homebuyers contributions up to 50 of the total down paymentclosing costs not to exceed 5000. Some of the most common include.

If youre looking to buy a 300000. Contact our Housing Counselor at 724-287-6797 ext. A first time homebuyer is defined as households that have not owned real property in the past 3 years.

Right now my wife and I own a home we bought through the San Diego First time. Michigan Down Payment Assistance Programs. But almost every other loan type including an FHA loan will require you to make a down payment.

240 to schedule an appointment for Pre-Purchase Home-ownership Counseling. It just makes better since because getting one loan or a fixed rate. This type of mortgage requires a fixed-rate loan.

Once you know that amount youll have a target to save for35 for a down payment and at least another 3. That means the real answer depends on how much you intend to borrow. The Michigan State Housing Development Authority MSHDA offers a few different home buyer assistance programs.

First time homebuyers who dont have a down payment end up doing an 8020 and usually on a 228 or similar product.

Avoid Foreclosure Moshes Law Firm 888 445 0234

37361 Tn Real Estate Homes For Sale Redfin

37361 Tn Real Estate Homes For Sale Redfin

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

2230 Mill Rd Binghamton Ny 13903 Mls 318144 Howard Hanna

Eagle Rock Homes For Sale Redfin Eagle Rock Mo Real Estate Houses For Sale In Eagle Rock Mo Homes For Sale Eagle Rock Mo

2230 Mill Rd Binghamton Ny 13903 Mls 318144 Howard Hanna

Benton Homes For Sale Redfin Benton Tn Real Estate Houses For Sale In Benton Tn Homes For Sale Benton Tn

Yfjb2v9op Lqnm

Wzsbkn1p6dlu1m

Sierra Pacific Mortgage Reviews

Kelowna New Homes For Sale Home

Angelika Angie Rahney Owner Broker Realtor Green Certified Military Residential Specialist Cmrs Csspe Csm Angie S Realty Linkedin

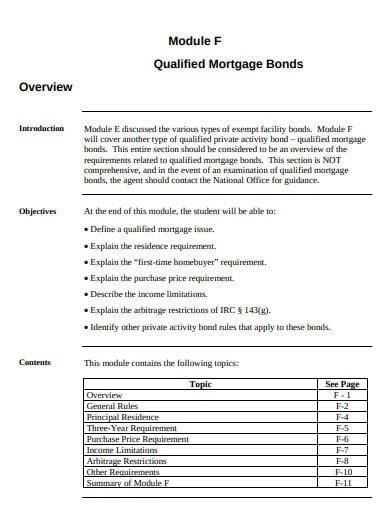

11 Mortgage Bond Templates In Pdf Doc Free Premium Templates

423 Works Road Rush Ny 14472 Mls R1393652 Howard Hanna

Basic Rental Agreement Download Free Printable Rental Legal Form Template Or Waiver Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

2